|

Author

|

Topic: real estate forecast`

|

SFvert

Drama kids have no place here

Member # 3965

|

posted

posted

was thinking of buying a house for a possible long term investment, since houses in certain areas are dirt cheap. What do you guys think the market is going to do in certain area such as the east bay where the market has been really down. Do you guys see any type of home price increases in the near future? thanks ![[patriot]](graemlins/patriot.gif)

--------------------

R.I.P. 89 LX Sold the 90 Vert,

I bring the Amber Lamps!!!

[IMG]http://images.encyclopediadramatica.com/images/5/53/Epicbeardmanwin.jpg[/IMG]

Posts: 3706 | From: the city by the bay | Registered: Jan 2004

| :

|

|

asskickn88

¯

Member # 4957

|

posted

posted

Everyone keeps saying there's another big wave of foreclosures coming so you might be better off holding out. I'm sure a few others will chime in and let you know what they find.

--------------------

Three 540 Bimmers and a 5.0 Explorer.... got a Ford back in the stable!

It's time for the country to do what Obama's own father did.

Abandon him.

Posts: 6069 | From: Rocklin, Ca | Registered: Oct 2004

| :

|

|

|

|

SmokeyBurnout

¯

Member # 5745

|

posted

posted

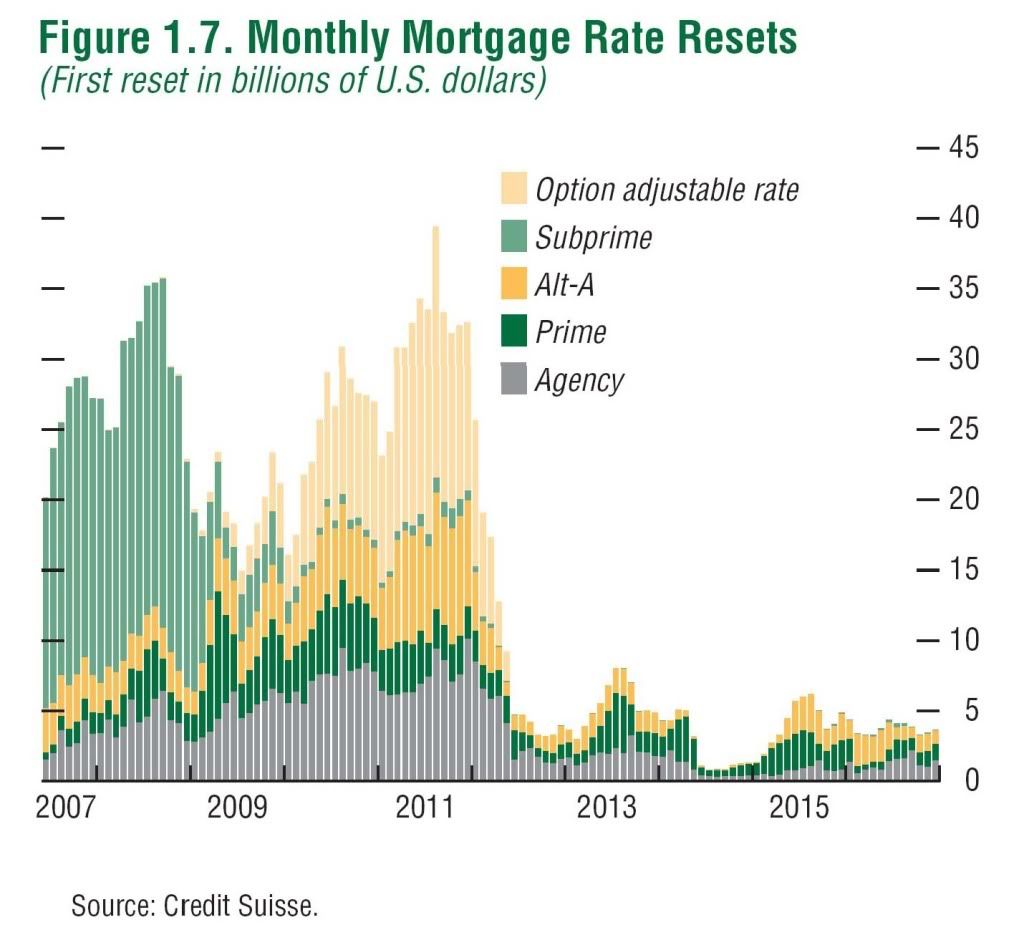

Yes, there is another wave of loan resets that most people don't know about. Some say the next crash will be worse because the dollar amount in question is larger. Sub-prime was the first crash and the Option-Arm and Alt-A will be next. You know all the interest only, pick a pay, 1% B.S. garbage loans, that is Alt-A and Op-Arm. The next wave of loan resets really picks up in early next year, that is when prices will drop again, IMO.

With everything else in our economy, job loses, looming stock market and Financial crash, government printing money out of thin air, nObama spending like crazy, bankrupt cities, states and fed, more new taxes, oh and we are at war as well, I could go on but you get the idea. Things don't look good. LMAO! ![[Big Grin]](biggrin.gif)

Here is a chart showing the loans that are about to reset and the dollar amounts. To me it pretty much shows how fucked we are. Bottom line is either way prices are not going up for at least 5-10 years but it looks like there could be a crash looming so do what you must. Good luck! ![[Big Grin]](biggrin.gif)

[ December 01, 2009, 02:39 AM: Message edited by: SmokeyBurnout ]

Posts: 513 | Registered: May 2005

| :

|

|

Wildfire532FB

CAFords OG

Member # 1482

|

posted

posted

Cool i am going to buy a house next year then.

--------------------

./_ _ _ ___ __\

(]]]_ _ o _ _[[[)

|\_o_ __ __o_/|

|__|..........|__|

68 Fastback

84 CJ7

94 HMMWV

95 GT

03 F350

17 Fusion Hybrid

Posts: 17578 | From: 530 | Registered: Jun 2002

| :

|

|

mikeP

¯

Member # 4489

|

posted

posted

live simple, and always save for the rainy days...if we even make to the year 2015......

--------------------

91 vert lx 5.0, 68 CS, 69 BB nova

Posts: 975 | Registered: May 2004

| :

|

|

N8

¯

Member # 6048

|

posted

posted

yea wait..I would say another 2-3 years to maximize gains. But be looking during this time for one of those unbelievable deals. I am upside down on 2 properties but pride wont let me walk. But if I come into a short sale situation I am walking on one of them. If you can get a short sale property or buy a foreclosed I would say do it.

Posts: 11638 | Registered: Sep 2005

| :

|

|

Luke87GT

Lay'n more stripes

than Caltrans

Member # 21

|

posted

posted

quote:

Originally posted by N8:

yea wait..I would say another 2-3 years to maximize gains. But be looking during this time for one of those unbelievable deals. I am upside down on 2 properties but pride wont let me walk. But if I come into a short sale situation I am walking on one of them. If you can get a short sale property or buy a foreclosed I would say do it.

The man knows what he is talking about. I am surprised that walking away from an underwater loan is not more common than it is. Nate, I think you hit the nail on the head about it being a pride/shame/morality issue for many people.

Take a look at this article that talks about this topic to a T

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/11/28/REG81AP4K1.DTL

I personally am about 15% underwater on my home now, and its very tempting to buy a short sale in the next 1-2 years and walking away. The items that are holding me back:

1.) I don't want to close the door to grad school. By destroying my credit, I may have problems getting a school loan

2.) A general concern that I don't completely understand all the sequence of events of going into foreclosure and the lasting effects. Sure you go into foreclosure, you get evicted, your credit score suffers. But obviously it is MUCH more complicated than this and there are likely hidden implications that I am not considering.

Anyway, I've been weighing the options of walking away for the past year. WF could have swayed my decision against it if they let me refi for under 5% like I tried to do several times, but the LTV is just over what they will give me prime rate for.

--------------------

Stangless

Posts: 7802 | From: San Mateo | Registered: Jul 2000

| :

|

|

N8

¯

Member # 6048

|

posted

posted

quote:

Originally posted by Luke87GT:

quote:

Originally posted by N8:

yea wait..I would say another 2-3 years to maximize gains. But be looking during this time for one of those unbelievable deals. I am upside down on 2 properties but pride wont let me walk. But if I come into a short sale situation I am walking on one of them. If you can get a short sale property or buy a foreclosed I would say do it.

The man knows what he is talking about. I am surprised that walking away from an underwater loan is not more common than it is. Nate, I think you hit the nail on the head about it being a pride/shame/morality issue for many people.

Take a look at this article that talks about this topic to a T

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/11/28/REG81AP4K1.DTL

I personally am about 15% underwater on my home now, and its very tempting to buy a short sale in the next 1-2 years and walking away. The items that are holding me back:

1.) I don't want to close the door to grad school. By destroying my credit, I may have problems getting a school loan

2.) A general concern that I don't completely understand all the sequence of events of going into foreclosure and the lasting effects. Sure you go into foreclosure, you get evicted, your credit score suffers. But obviously it is MUCH more complicated than this and there are likely hidden implications that I am not considering.

Anyway, I've been weighing the options of walking away for the past year. WF could have swayed my decision against it if they let me refi for under 5% like I tried to do several times, but the LTV is just over what they will give me prime rate for.

Luke I have been researching the effects of a foreclosure/short on a persons credit. And basically it boils down to your name is mud for 4 years with a foreclosure and 2 years with a short sale. The good thing about my situation is that none of our properties are in my name. But my wife also discovered a clever use of our credit cards. But you basically use them and pay off a certain amount by the date they report. So her credit score goes up consistently every month. We also use MyFICO to track her credit. So you can do the FC but manage your credit from the point exceptionally well and come out clean byt the time things get really bad.

Just to add, make sure all your car buying a school stuff loans are gather prior. becuause you will get treated like the red-headed step child right after a FC

And to the OP

House prices will not be right for quite sometime. I think we will be old men before it is back to where it was some 10 years ago. So if you are looking for ROI be thinking your kids will reap that. Not you.

[ December 01, 2009, 01:26 PM: Message edited by: N8 ]

Posts: 11638 | Registered: Sep 2005

| :

|

|

turbo50

¯

Member # 6700

|

posted

posted

What about the state taxes that come into play when being foreclosed on?

--------------------

.........when was the last time YOU built something with YOUR own hands?

I offer quality sidework at reasonable prices. PM ME

Posts: 7606 | From: Discovery Bay, California | Registered: Apr 2006

| :

|

|

N8

¯

Member # 6048

|

posted

posted

quote:

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

[ December 01, 2009, 01:32 PM: Message edited by: N8 ]

Posts: 11638 | Registered: Sep 2005

| :

|

|

turbo50

¯

Member # 6700

|

posted

posted

Nah Ill have to get some details but my buddy just went through this and he had to pay some severe state tax penalties.

--------------------

.........when was the last time YOU built something with YOUR own hands?

I offer quality sidework at reasonable prices. PM ME

Posts: 7606 | From: Discovery Bay, California | Registered: Apr 2006

| :

|

|

N8

¯

Member # 6048

|

posted

posted

quote:

Originally posted by turbo50:

Nah Ill have to get some details but my buddy just went through this and he had to pay some severe state tax penalties.

When you get some info please share it. As I may go through this soon.

Posts: 11638 | Registered: Sep 2005

| :

|

|

turbo50

¯

Member # 6700

|

posted

posted

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Not true. This is what happened to him:

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

--------------------

.........when was the last time YOU built something with YOUR own hands?

I offer quality sidework at reasonable prices. PM ME

Posts: 7606 | From: Discovery Bay, California | Registered: Apr 2006

| :

|

|

N8

¯

Member # 6048

|

posted

posted

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Not true. This is what happened to him:

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Posts: 11638 | Registered: Sep 2005

| :

|

|

turbo50

¯

Member # 6700

|

posted

posted

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Not true. This is what happened to him:

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

This is what happened to my buddy.

--------------------

.........when was the last time YOU built something with YOUR own hands?

I offer quality sidework at reasonable prices. PM ME

Posts: 7606 | From: Discovery Bay, California | Registered: Apr 2006

| :

|

|

BIGBALLFACTOR

¯

Member # 7277

|

posted

posted

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Not true. This is what happened to him:

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

This is what happened to my buddy.

Dan you buddy needs to talk to a real estate lawyer there was around that with tax right offs

Posts: 6908 | From: okc | Registered: Dec 2006

| :

|

|

N8

¯

Member # 6048

|

posted

posted

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Not true. This is what happened to him:

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

This is what happened to my buddy.

I follow you and damn, I am going to look into it. Gonna ask around, I kinda mentioned it to my Aunt just now and she said those are rarely granted. Most in the cases where the houses are huge amount homes. And the bank has to go above and beyond to show there will never be the ability to gain those monies back. But I am gonna research this. I dont want the bank screwing me.

Posts: 11638 | Registered: Sep 2005

| :

|

|

50Reasons

¯

Member # 6452

|

posted

posted

All this talk about walking away makes me thankful I bought two of my properties in a down housing market and wasn't tempted to buy when the market skyrocketed and I'm am probably the few who still have some equity in my homes

--------------------

50Reasons Car Club President

Daniel/50Reasons

http://youtu.be/n_UkDg_F4MQ

https://youtu.be/066xRvxKy-g

Posts: 9483 | From: Sacramento Ca | Registered: Jan 2006

| :

|

|

N8

¯

Member # 6048

|

posted

posted

quote:

Originally posted by 50Reasons:

All this talk about walking away makes me thankful I bought two of my properties in a down housing market and wasn't tempted to buy when the market skyrocketed and I'm am probably the few who still have some equity in my homes

Dont count your chickens before they hatch, the market is gonna drop again. Folks with ARMs are next. That is gonna be ridiculous. I am jumping back in around that time. I wish I would have walked at the beginning of this whole thing.

I am giving my lender on one property one more chance to restructure my loan then I may bounce on it.

[ December 01, 2009, 04:34 PM: Message edited by: N8 ]

Posts: 11638 | Registered: Sep 2005

| :

|

|

Yaterstang

¯

Member # 7659

|

posted

posted

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Not true. This is what happened to him:

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

This is what happened to my buddy.

Typically there is no deficiency balance on a foreclosure in california unless there is a judicial foreclosure. The liability is attached to the property and the bank has no recourse to come after the homeowner after it has been foreclosed. http://www.foreclosurefish.com/ca.htm

Posts: 2968 | From: Natomas | Registered: May 2007

| :

|

|

N8

¯

Member # 6048

|

posted

posted

quote:

Originally posted by Yaterstang:

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

quote:

Originally posted by N8:

quote:

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Not true. This is what happened to him:

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

This is what happened to my buddy.

Typically there is no deficiency balance on a foreclosure in california unless there is a judicial foreclosure. The liability is attached to the property and the bank has no recourse to come after the homeowner after it has been foreclosed. http://www.foreclosurefish.com/ca.htm

My initial research backs this up, plus what my Aunt said. It is far and few. Sounds like your boy should get a lawyer

Posts: 11638 | Registered: Sep 2005

| :

|

|

Mr.Lucky

CAFords OG

Member # 1772

|

posted

posted

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

--------------------

95GT: Bolt ons.

Good sellers/buyers: Stangs R Us, 1SicGt, sn4bwc, racsirx, WickedStang, Autumnstang97, cali95gt

Posts: 4197 | From: Manteca | Registered: Sep 2002

| :

|

|

50Reasons

¯

Member # 6452

|

posted

posted

quote:

Originally posted by N8:

quote:

Originally posted by 50Reasons:

All this talk about walking away makes me thankful I bought two of my properties in a down housing market and wasn't tempted to buy when the market skyrocketed and I'm am probably the few who still have some equity in my homes

Dont count your chickens before they hatch, the market is gonna drop again. Folks with ARMs are next. That is gonna be ridiculous. I am jumping back in around that time. I wish I would have walked at the beginning of this whole thing.

I am giving my lender on one property one more chance to

restructure my loan then I may bounce on it.

the market can drop 100 k and I will still be ok

only owe 60k on my first house in 7 to 10 it will be payed off then will be able to buy my third in a still down market again ![[Big Grin]](biggrin.gif)

[ December 01, 2009, 06:08 PM: Message edited by: 50Reasons ]

--------------------

50Reasons Car Club President

Daniel/50Reasons

http://youtu.be/n_UkDg_F4MQ

https://youtu.be/066xRvxKy-g

Posts: 9483 | From: Sacramento Ca | Registered: Jan 2006

| :

|

|

BIGBALLFACTOR

¯

Member # 7277

|

posted

posted

quote:

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA solely on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

time for a new agent my step dad get people in to homes alot in the eastbay

Posts: 6908 | From: okc | Registered: Dec 2006

| :

|

|

Email this post to someone!

Email this post to someone!

Printer friendly view of this Ford topic

Printer friendly view of this Ford topic