Originally posted by 90FoX:

^^ Full Cash.... wow!

![[dance]](graemlins/dance.gif)

Do any of you think the govt is going to try to prevent another crash by possibly bailing out banks again who refi these people to try and prevent what just happened?

![[patriot]](graemlins/patriot.gif)

![[Big Grin]](biggrin.gif)

![[Big Grin]](biggrin.gif)

quote:The man knows what he is talking about. I am surprised that walking away from an underwater loan is not more common than it is. Nate, I think you hit the nail on the head about it being a pride/shame/morality issue for many people.

Originally posted by N8:

yea wait..I would say another 2-3 years to maximize gains. But be looking during this time for one of those unbelievable deals. I am upside down on 2 properties but pride wont let me walk. But if I come into a short sale situation I am walking on one of them. If you can get a short sale property or buy a foreclosed I would say do it.

quote:Luke I have been researching the effects of a foreclosure/short on a persons credit. And basically it boils down to your name is mud for 4 years with a foreclosure and 2 years with a short sale. The good thing about my situation is that none of our properties are in my name. But my wife also discovered a clever use of our credit cards. But you basically use them and pay off a certain amount by the date they report. So her credit score goes up consistently every month. We also use MyFICO to track her credit. So you can do the FC but manage your credit from the point exceptionally well and come out clean byt the time things get really bad.

Originally posted by Luke87GT:

quote:The man knows what he is talking about. I am surprised that walking away from an underwater loan is not more common than it is. Nate, I think you hit the nail on the head about it being a pride/shame/morality issue for many people.

Originally posted by N8:

yea wait..I would say another 2-3 years to maximize gains. But be looking during this time for one of those unbelievable deals. I am upside down on 2 properties but pride wont let me walk. But if I come into a short sale situation I am walking on one of them. If you can get a short sale property or buy a foreclosed I would say do it.

Take a look at this article that talks about this topic to a T

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/11/28/REG81AP4K1.DTL

I personally am about 15% underwater on my home now, and its very tempting to buy a short sale in the next 1-2 years and walking away. The items that are holding me back:

1.) I don't want to close the door to grad school. By destroying my credit, I may have problems getting a school loan

2.) A general concern that I don't completely understand all the sequence of events of going into foreclosure and the lasting effects. Sure you go into foreclosure, you get evicted, your credit score suffers. But obviously it is MUCH more complicated than this and there are likely hidden implications that I am not considering.

Anyway, I've been weighing the options of walking away for the past year. WF could have swayed my decision against it if they let me refi for under 5% like I tried to do several times, but the LTV is just over what they will give me prime rate for.

quote:All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

quote:When you get some info please share it. As I may go through this soon.

Originally posted by turbo50:

Nah Ill have to get some details but my buddy just went through this and he had to pay some severe state tax penalties.

quote:Not true. This is what happened to him:

Originally posted by N8:

quote:All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

quote:Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Originally posted by turbo50:

quote:Not true. This is what happened to him:

Originally posted by N8:

quote:All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

quote:Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

Originally posted by N8:

quote:Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Originally posted by turbo50:

quote:Not true. This is what happened to him:

Originally posted by N8:

quote:All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

quote:Dan you buddy needs to talk to a real estate lawyer there was around that with tax right offs

Originally posted by turbo50:

quote:Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

Originally posted by N8:

quote:Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Originally posted by turbo50:

quote:Not true. This is what happened to him:

Originally posted by N8:

quote:All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

This is what happened to my buddy.

quote:I follow you and damn, I am going to look into it. Gonna ask around, I kinda mentioned it to my Aunt just now and she said those are rarely granted. Most in the cases where the houses are huge amount homes. And the bank has to go above and beyond to show there will never be the ability to gain those monies back. But I am gonna research this. I dont want the bank screwing me.

Originally posted by turbo50:

quote:Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

Originally posted by N8:

quote:Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Originally posted by turbo50:

quote:Not true. This is what happened to him:

Originally posted by N8:

quote:All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

This is what happened to my buddy.

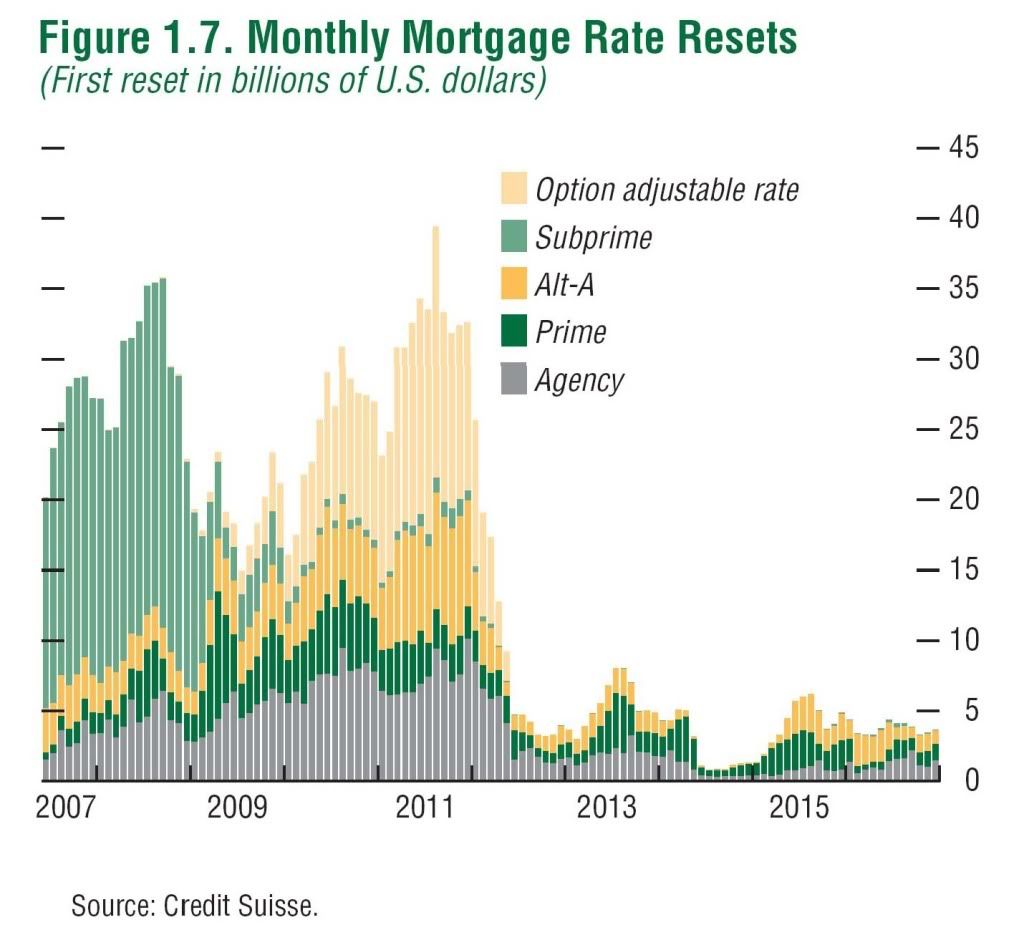

quote:Dont count your chickens before they hatch, the market is gonna drop again. Folks with ARMs are next. That is gonna be ridiculous. I am jumping back in around that time. I wish I would have walked at the beginning of this whole thing.

Originally posted by 50Reasons:

All this talk about walking away makes me thankful I bought two of my properties in a down housing market and wasn't tempted to buy when the market skyrocketed and I'm am probably the few who still have some equity in my homes

quote:Typically there is no deficiency balance on a foreclosure in california unless there is a judicial foreclosure. The liability is attached to the property and the bank has no recourse to come after the homeowner after it has been foreclosed. http://www.foreclosurefish.com/ca.htm

Originally posted by turbo50:

quote:Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

Originally posted by N8:

quote:Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Originally posted by turbo50:

quote:Not true. This is what happened to him:

Originally posted by N8:

quote:All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

This is what happened to my buddy.

quote:My initial research backs this up, plus what my Aunt said. It is far and few. Sounds like your boy should get a lawyer

Originally posted by Yaterstang:

quote:Typically there is no deficiency balance on a foreclosure in california unless there is a judicial foreclosure. The liability is attached to the property and the bank has no recourse to come after the homeowner after it has been foreclosed. http://www.foreclosurefish.com/ca.htm

Originally posted by turbo50:

quote:Ok so ill explain....you walk away...foreclosure....the bank gets a deficiency judgement....you file bankruptcy or do what you gotta do so they dont attach your paycheck...they (bank or lender) forgive the deficiency judgement...that amount say 100,000 is treated as taxable income.....

Originally posted by N8:

quote:Ok that is understandable, I understand the possibility of capitol gains tax and what you outlined. But a FC is just walking on the debt and not asking for a forgiveness on anything. Sounds like you are referring to a Short Sale. Or some kind of gov't program.

Originally posted by turbo50:

quote:Not true. This is what happened to him:

Originally posted by N8:

quote:All that is wiped away. And becomes the responsibility of the bank. Which is why the bank will try to rub that off on any potential future buyer.

Originally posted by turbo50:

What about the state taxes that come into play when being foreclosed on?

I am so close to bouncing on 2 of our properties. But I will do the nice thing and let my tennant stay there as long as they can rent free.

Income Taxes. It might seem strange to discuss income taxes for someone facing foreclosure, but if a deficiency judgment is granted and then forgiven by the bank or lender, the amount is treated as income and is subject to taxation. Not only can this take many by surprise, but it often results in a higher tax bracket for the entire household– a consideration that could lead to potential federal tax liens or other serious debt obligations that cannot be easily eliminated, even when filing for bankruptcy protection.

This is what happened to my buddy.

quote:the market can drop 100 k and I will still be ok

Originally posted by N8:

quote:Dont count your chickens before they hatch, the market is gonna drop again. Folks with ARMs are next. That is gonna be ridiculous. I am jumping back in around that time. I wish I would have walked at the beginning of this whole thing.

Originally posted by 50Reasons:

All this talk about walking away makes me thankful I bought two of my properties in a down housing market and wasn't tempted to buy when the market skyrocketed and I'm am probably the few who still have some equity in my homes

I am giving my lender on one property one more chance to

restructure my loan then I may bounce on it.

![[Big Grin]](biggrin.gif)

quote:time for a new agent my step dad get people in to homes alot in the eastbay

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA solely on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

![[dance]](graemlins/dance.gif)

![[dance]](graemlins/dance.gif)

quote:why there lots of people that have lots of cash laying around.most inverters have partners an the pool there moneys together to buy an flip houses

Originally posted by 90FoX:

^^ Full Cash.... wow!![[dance]](graemlins/dance.gif)

Do any of you think the govt is going to try to prevent another crash by possibly bailing out banks again who refi these people to try and prevent what just happened?

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

quote:THIS

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

quote:Good luck getting that to go through, because when you do an FHA loan, the seller must sign an addendum and real estate cert that will prevent the seller from keeping the buyers deposit if they dont get their loan. This is a complete jackass approach because as soon as you send over the addendum, the seller is going to back out.

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

quote:That might work in some cases. But when I bought my house the bank that was selling the house wanted a pre approval letter to go along with my conventional financing offer from whoever I was getting financing through. Now if I didnt have the money for the 20% down the mortgage company wouldnt have pre approved me for conventional financing and they would have not accepted my offer. Every bank selling an REO is different when accepting terms/offers.

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

quote:bottle keep at it man we searched for about a year until we finaly were able to find one they actually mis listed so we swooped on it. drive around areas that you want to look at and keep a eye out, thats how we got our place... another great site is www.camoves.com they are really up to date on their listings. We did FHA and it was well worth it, actually just got our interest rate droped down to 5.3 from 6.5 at the begining.

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

quote:the listing agent can fuck big time

Originally posted by N8:

quote:THIS

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

quote:The crash will happen. The ARM folks are just starting to feel the bite. Oh and the interest only folks.

Originally posted by liftedF150:

quote:bottle keep at it man we searched for about a year until we finaly were able to find one they actually mis listed so we swooped on it. drive around areas that you want to look at and keep a eye out, thats how we got our place... another great site is <a href="http://www.camoves.com" target="_blank" rel="nofollow">www.camoves.com</a> they are really up to date on their listings. We did FHA and it was well worth it, actually just got our interest rate droped down to 5.3 from 6.5 at the begining.

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

I honestly dont think its going to crash as hard as people say it is. its just a new breed of buyer they arnt older people with 20 % down alot of them are going to be first time home buyers that are younger and finaly have the oppirtunity to swoop on a house. There arnt any houses being built right now ( well very few ) so the demand will evently surpass the supply. As bottle said i went through it as well there would be 5 offers within the first day on some places but would take forever because the banks drag their feet because they are taking the hit.

quote:no doubt but there are plenty of people ready to buy those houses at a deal now, its all in the banks hands basicly...

Originally posted by N8:

quote:The crash will happen. The ARM folks are just starting to feel the bite. Oh and the interest only folks.

Originally posted by liftedF150:

quote:bottle keep at it man we searched for about a year until we finaly were able to find one they actually mis listed so we swooped on it. drive around areas that you want to look at and keep a eye out, thats how we got our place... another great site is <a href="http://www.camoves.com" target="_blank" rel="nofollow">www.camoves.com</a> they are really up to date on their listings. We did FHA and it was well worth it, actually just got our interest rate droped down to 5.3 from 6.5 at the begining.

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

I honestly dont think its going to crash as hard as people say it is. its just a new breed of buyer they arnt older people with 20 % down alot of them are going to be first time home buyers that are younger and finaly have the oppirtunity to swoop on a house. There arnt any houses being built right now ( well very few ) so the demand will evently surpass the supply. As bottle said i went through it as well there would be 5 offers within the first day on some places but would take forever because the banks drag their feet because they are taking the hit.

quote:Yea and thats what sucks.

Originally posted by liftedF150:

quote:no doubt but there are plenty of people ready to buy those houses at a deal now, its all in the banks hands basicly...

Originally posted by N8:

quote:The crash will happen. The ARM folks are just starting to feel the bite. Oh and the interest only folks.

Originally posted by liftedF150:

quote:bottle keep at it man we searched for about a year until we finaly were able to find one they actually mis listed so we swooped on it. drive around areas that you want to look at and keep a eye out, thats how we got our place... another great site is <a href="http://www.camoves.com" target="_blank" rel="nofollow">www.camoves.com</a> they are really up to date on their listings. We did FHA and it was well worth it, actually just got our interest rate droped down to 5.3 from 6.5 at the begining.

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

I honestly dont think its going to crash as hard as people say it is. its just a new breed of buyer they arnt older people with 20 % down alot of them are going to be first time home buyers that are younger and finaly have the oppirtunity to swoop on a house. There arnt any houses being built right now ( well very few ) so the demand will evently surpass the supply. As bottle said i went through it as well there would be 5 offers within the first day on some places but would take forever because the banks drag their feet because they are taking the hit.

quote:well it sucks for the people that got mislead on their loans and took it in the shorts, but it will in the end help the economy and home sales

Originally posted by N8:

quote:Yea and thats what sucks.

Originally posted by liftedF150:

quote:no doubt but there are plenty of people ready to buy those houses at a deal now, its all in the banks hands basicly...

Originally posted by N8:

quote:The crash will happen. The ARM folks are just starting to feel the bite. Oh and the interest only folks.

Originally posted by liftedF150:

quote:bottle keep at it man we searched for about a year until we finaly were able to find one they actually mis listed so we swooped on it. drive around areas that you want to look at and keep a eye out, thats how we got our place... another great site is <a href="http://www.camoves.com" target="_blank" rel="nofollow">www.camoves.com</a> they are really up to date on their listings. We did FHA and it was well worth it, actually just got our interest rate droped down to 5.3 from 6.5 at the begining.

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

I honestly dont think its going to crash as hard as people say it is. its just a new breed of buyer they arnt older people with 20 % down alot of them are going to be first time home buyers that are younger and finaly have the oppirtunity to swoop on a house. There arnt any houses being built right now ( well very few ) so the demand will evently surpass the supply. As bottle said i went through it as well there would be 5 offers within the first day on some places but would take forever because the banks drag their feet because they are taking the hit.

![[patriot]](graemlins/patriot.gif)

quote:i know man it sucks but i was in the same exact situation we had about 6% saved up but you are really going to have to do some leg work and find the hidden deals, you cant rely on your agent to find you places, we found all the places and make our agent take us or find out info on it. were are you looking bottle? my agent is now in charge of alot of the REO's for wamu now thanks to the sale of our place

Originally posted by bottled95GT??:

My issue is I have just over the 3.5% saved. No where near the 20% your friends did. I woulda already went conventional if I had that. New agent possible but my pre approval amount and the market I'm in leaves me in a very competitive market and I've spoken to various agents and friends who are running into the same problem. Being banks are favoring cash offers over FHA 99/100 offers. Cash is king right now. Fasthatch PM me his info![[patriot]](graemlins/patriot.gif)

![[Smile]](smile.gif)

quote:Exactly, if the LOAN doesn't fall through then you're pretty much SOL.

Originally posted by Yaterstang:

quote:Good luck getting that to go through, because when you do an FHA loan, the seller must sign an addendum and real estate cert that will prevent the seller from keeping the buyers deposit if they dont get their loan. This is a complete jackass approach because as soon as you send over the addendum, the seller is going to back out.

Originally posted by AL STOCK:

quote:Wait what? Are you pre-approved? FHA shouldn't be a problem if you are offering close to or little above asking price.

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."

For example:

YOu see a house for $450K, your FHA is for $470K. You offer $460K straighg with the listing agent. In the actual offer letter, you put down that you are doing a 20% down. Once the bank approves your letter, you pull out the FHA stuff and do the 3.5% down.

I know about 3 folks who bought houses in the Penninsula under FHA terms and both had above 20% down ready too but they saved alot of money.

Either your real estate agent sucks monkey balls or you need a better one. The key in this whole situation is to deal with the LISTING AGENT directly.

![[Frown]](frown.gif)

quote:hey im in discovery bay and my court actually has 2 places that may be going through forclosure you may be able to swoop on them, they are awesome houses...

Originally posted by bottled95GT??:

edit

*Lifted*

ya thats kind of what ive been doing. On top of MLS emails i search californiamoves, and various listing sites. My Market is Antioch, Oakley, Brentwood, and Pittsburg. Reasoning, on my salary im only preapproved to $200K.![[Frown]](frown.gif)

quote:Ahh i see! No wonder.

Originally posted by bottled95GT??:

edit

*Lifted*

ya thats kind of what ive been doing. On top of MLS emails i search californiamoves, and various listing sites. My Market is Antioch, Oakley, Brentwood, and Pittsburg. Reasoning, on my salary im only preapproved to $200K.![[Frown]](frown.gif)

quote:i look for them thanks bud.

Originally posted by liftedF150:

quote:hey im in discovery bay and my court actually has 2 places that may be going through forclosure you may be able to swoop on them, they are awesome houses...

Originally posted by bottled95GT??:

edit

*Lifted*

ya thats kind of what ive been doing. On top of MLS emails i search californiamoves, and various listing sites. My Market is Antioch, Oakley, Brentwood, and Pittsburg. Reasoning, on my salary im only preapproved to $200K.![[Frown]](frown.gif)

![[patriot]](graemlins/patriot.gif) down payament assistance programs are good, but only if you find cities with 1) funding for the program and 2) cities the have funding and willing banks.

down payament assistance programs are good, but only if you find cities with 1) funding for the program and 2) cities the have funding and willing banks. ![[patriot]](graemlins/patriot.gif)

quote:pm sent his waiting on your call

Originally posted by bottled95GT??:

yup got one for oakland and tracydown payament assistance programs are good, but only if you find cities with 1) funding for the program and 2) cities the have funding and willing banks.

![[patriot]](graemlins/patriot.gif)

quote:ya you need a new agent!!! i remember when you started looking, i started looking in aug and closed at the end of oct!!!

Originally posted by bottled95GT??:

All I know is I've been house shopping for a year now. In the past 7 months I've submitted multiple offers on 12 different properties and lost in highest and best to investors coming in full cash! I'm 25 and doing FHA soley on my income. I have the $ for FHA not for conventional and that sucks. I've had to pass on many great houses cuz they won't qualify FHA =/ 25 years old with a 791 credit score as of my revised credit check and I still can't give my wife and daughter a house. Fucking depressing. Gets old hearing "just keep trying, there's more houses to come."