Originally posted by FivePTSlow:

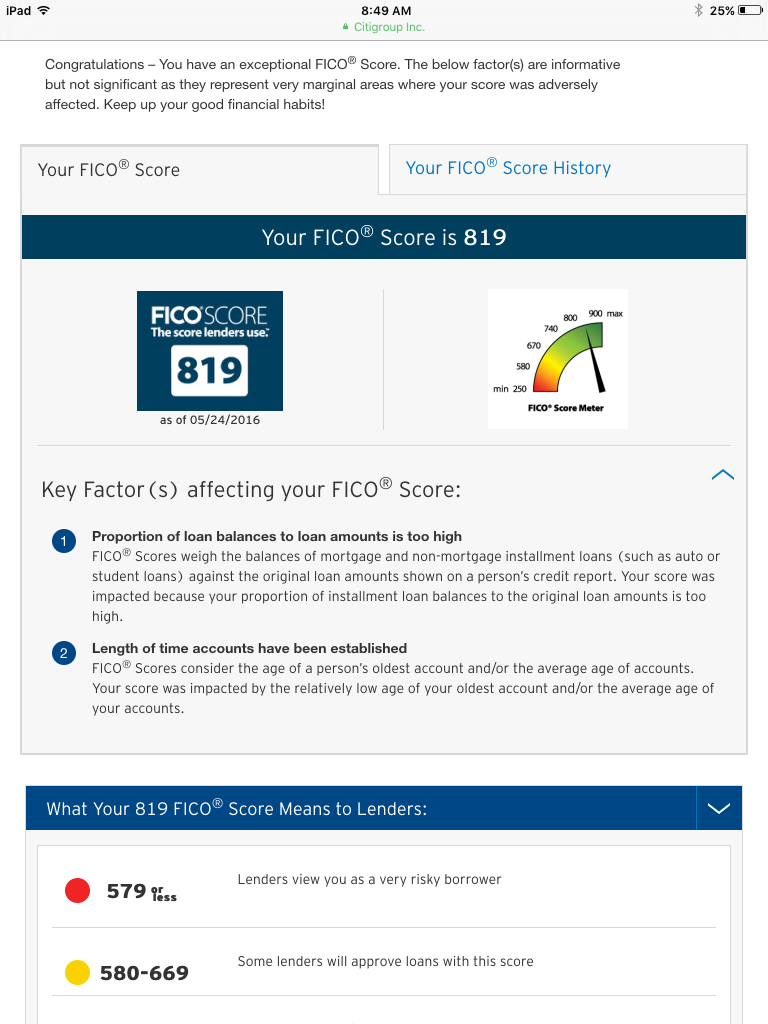

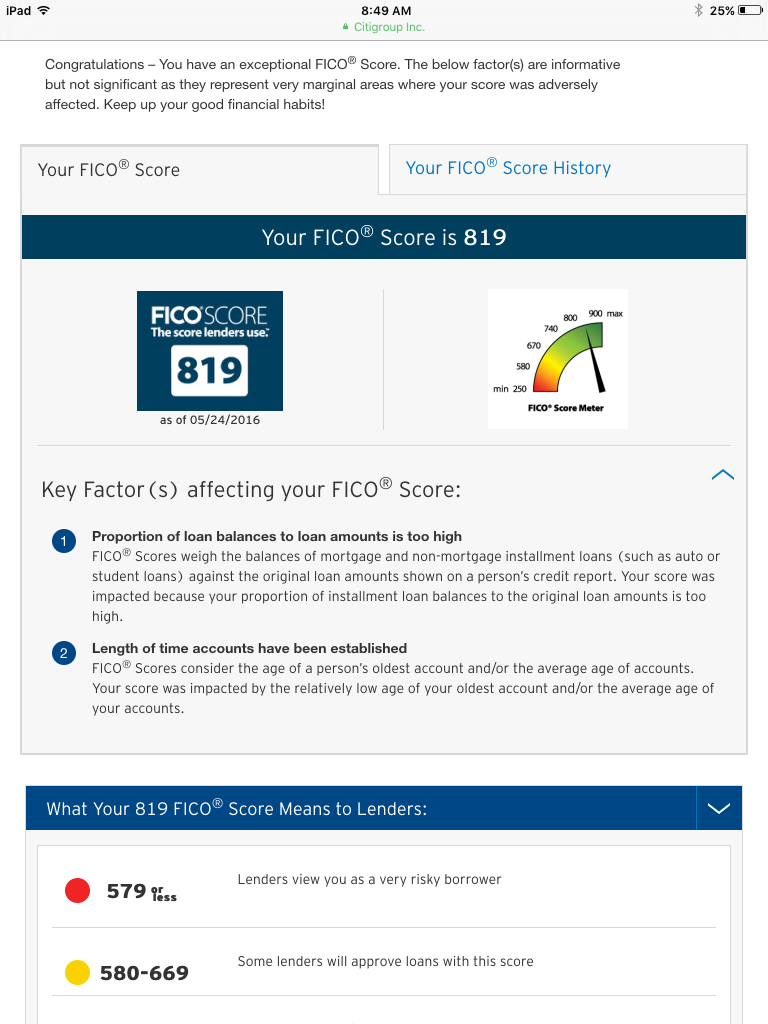

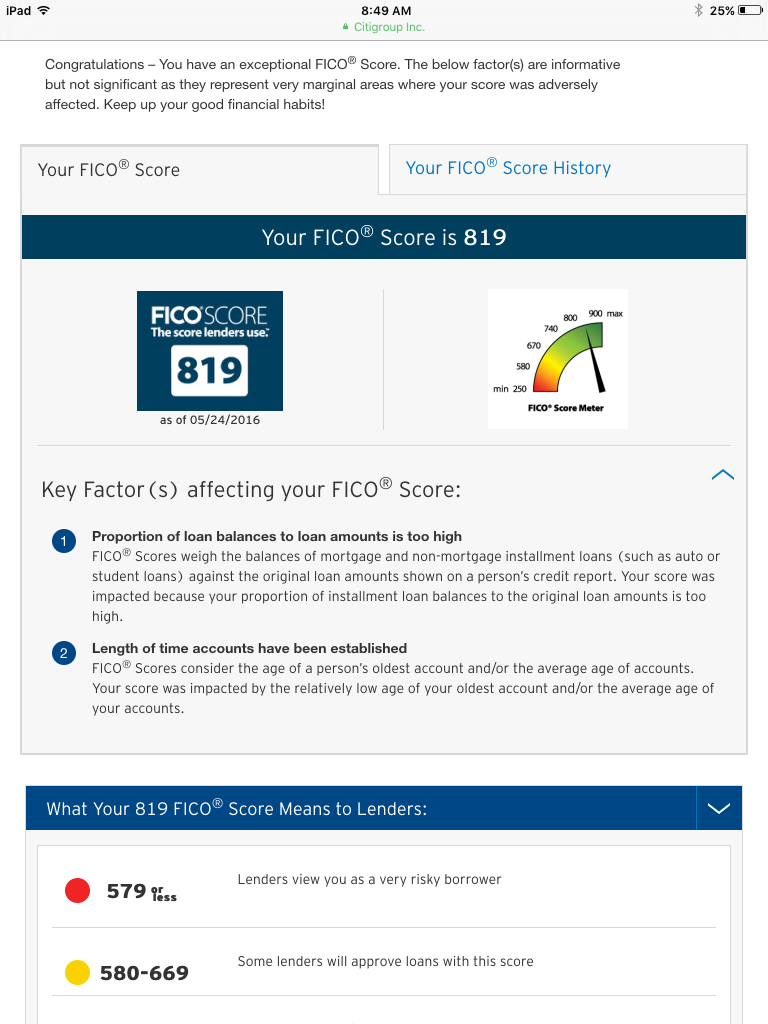

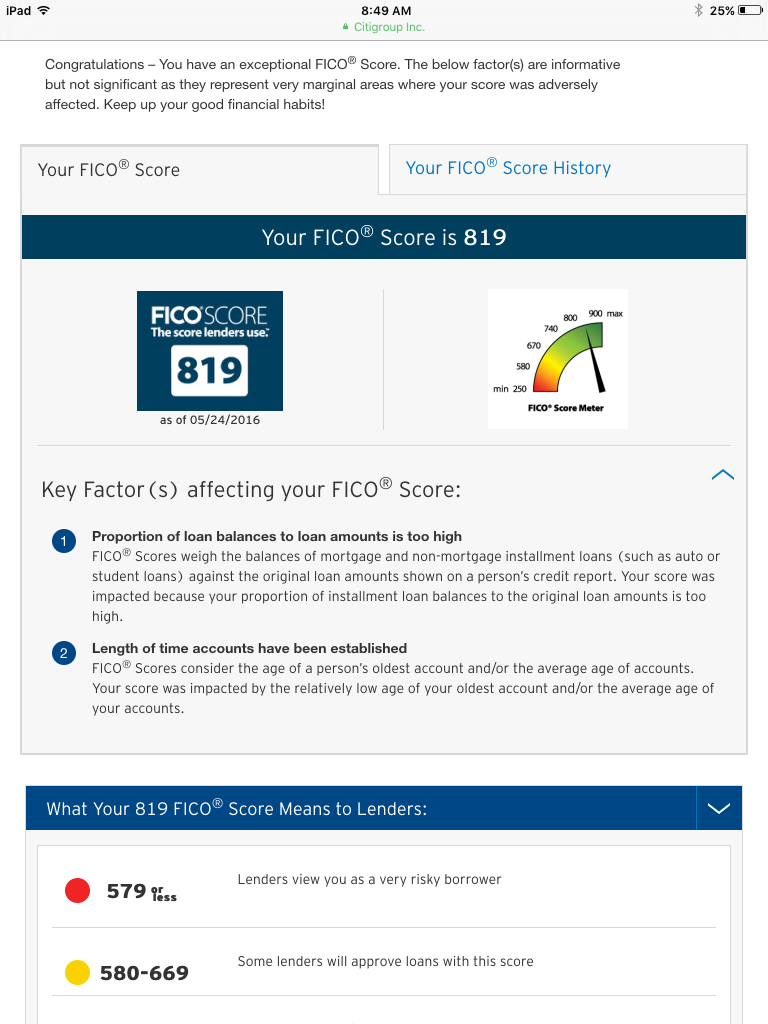

Here's where one of my scores is at, all 3 are above 800

quote:Does this one show you everything in your credit?

Originally posted by fredfifty:

www.annualcreditreport.com is free and legit

quote:yes minus the credit score, but i see thats what you need...

Originally posted by triple black hatch:

quote:Does this one show you everything in your credit?

Originally posted by fredfifty:

www.annualcreditreport.com is free and legit

quote:Legit. You get to check all 3 companies per year. I checked one only every 3 months to see my improvements.

Originally posted by fredfifty:

www.annualcreditreport.com is free and legit

quote:Pm sent! ....jk lol

Originally posted by SLOWBACK 67:

Just send me your SSN, Mothers maiden name and I will give anyone here a free credit check.

quote:+10000000000

Originally posted by Boosted_DropTop:

Creditkarma

quote:This is true, creditkarma seems to miscalculate your score lower than it actually is, so that you sign up for stuff on their sight. I've used it as a tool to build my credit. It breaks down all of the different categories and how they change your score etc

Originally posted by Fostang:

Credit karma is far from being accurate. Having said though it gives you a general basis of what your current score is and how if any improvement you have made.

quote:Yup, about 10 of my cards show and update your score regularly, these are spot on your actual credit score, unlike credit karma. Credit karma is good though because your scores are updated often.mand it gives you full access to two of your complete credit reports free. Trans Union and equifax I believe.

Originally posted by LXjames:

If you have a credit card you can have them display your score on your statement or online.

quote:Show off! LOL! wish I had an 819 credit score

Originally posted by FivePTSlow:

Here's where one of my scores is at, all 3 are above 800

![[patriot]](graemlins/patriot.gif)

quote:not bad bro.....

Originally posted by FivePTSlow:

Here's where one of my scores is at, all 3 are above 800

quote:All you have to do is make it a focus. It's taken me about 3 years to go from a 672 to over 800. It's like playing an ongoing game, try to get the highest score possible while following the rules of the game.

Originally posted by East Bay 50:

quote:Show off! LOL! wish I had an 819 credit score

Originally posted by FivePTSlow:

[qb] Here's where one of my scores is at, all 3 are above 800![[patriot]](graemlins/patriot.gif)

quote:+1

Originally posted by adower:

Credit is overrated. The only thing I needed credit for was my mortgage.

![[Big Grin]](biggrin.gif)

quote:the R stands for Ruin.

Originally posted by SLOWBACK 67:

quote:+1

Originally posted by adower:

Credit is overrated. The only thing I needed credit for was my mortgage.

C.R.E.A.M![[Big Grin]](biggrin.gif)

![[Razz]](tongue.gif)

quote:LOL.

Originally posted by fredfifty:

quote:the R stands for Ruin.

Originally posted by SLOWBACK 67:

quote:+1

Originally posted by adower:

Credit is overrated. The only thing I needed credit for was my mortgage.

C.R.E.A.M![[Big Grin]](biggrin.gif)

![[Razz]](tongue.gif)

![[Eek!]](eek.gif) Fuck that shit LOL.

Fuck that shit LOL.

quote:aside from the obvious stuff like reducing debt and keeping your long standing credit cards open and active

Originally posted by FivePTSlow:

I'm getting there, the only thing holding me back now is the average age of my credit is low. That's the one area I can't do much about except wait.

Once I pay off my last of the credit card debts soon, and 3 inquiries drop off this year I'm sure I'll see a huge bump in my score.

quote:Drugs rule everything around me.

Originally posted by SLOWBACK 67:

Do we even want to know what the D stands for?

quote:I have about $100k in credit line for credit cards, that's way more than I'll ever use. I made sure to get my limits way up there, so even if I made a large purchase, my utilization will stay down and keep my score high.

Originally posted by venomous99:

quote:aside from the obvious stuff like reducing debt and keeping your long standing credit cards open and active

Originally posted by FivePTSlow:

I'm getting there, the only thing holding me back now is the average age of my credit is low. That's the one area I can't do much about except wait.

Once I pay off my last of the credit card debts soon, and 3 inquiries drop off this year I'm sure I'll see a huge bump in my score.

,it helps to increase your credit line every so often.

http://www.bankrate.com/finance/credit/will-credit-limit-increase-hurt-score.aspx

quote:Well depending on your lender they may pull from a different bureau, so it's good to know all 3 scores if possible. As much as I like credit karma, their numbers are always off for me, especially trans Union. Their score is always 40-60 points lower than my actual trans Union score. No idea why, it has all the same info, I would bet it's likely so they can try to sell you stuff.

Originally posted by stanger00:

I pay for transunion and have a discover card. I have 2 different FICO numbers from those two companies, lol.

I ran CreditKarma and it matches transunion. I prefer transunion simulation tools tho.

quote:That's great idea until your minimum payments add up to or over 40 to 50% of your monthly income.

Originally posted by FivePTSlow:

quote:I have about $100k in credit line for credit cards, that's way more than I'll ever use. I made sure to get my limits way up there, so even if I made a large purchase, my utilization will stay down and keep my score high.

Originally posted by venomous99:

quote:aside from the obvious stuff like reducing debt and keeping your long standing credit cards open and active

Originally posted by FivePTSlow:

I'm getting there, the only thing holding me back now is the average age of my credit is low. That's the one area I can't do much about except wait.

Once I pay off my last of the credit card debts soon, and 3 inquiries drop off this year I'm sure I'll see a huge bump in my score.

,it helps to increase your credit line every so often.

http://www.bankrate.com/finance/credit/will-credit-limit-increase-hurt-score.aspx

quote:My discover account provides me with a transunion FICO score.

Originally posted by FivePTSlow:

quote:Well depending on your lender they may pull from a different bureau, so it's good to know all 3 scores if possible. As much as I like credit karma, their numbers are always off for me, especially trans Union. Their score is always 40-60 points lower than my actual trans Union score. No idea why, it has all the same info, I would bet it's likely so they can try to sell you stuff.

Originally posted by stanger00:

I pay for transunion and have a discover card. I have 2 different FICO numbers from those two companies, lol.

I ran CreditKarma and it matches transunion. I prefer transunion simulation tools tho.

quote:more reason why you pay off your CC bills by the end of the month and not pay interest on cards.

Originally posted by stanger00:

quote:That's great idea until your minimum payments add up to or over 40 to 50% of your monthly income.

Originally posted by FivePTSlow:

quote:I have about $100k in credit line for credit cards, that's way more than I'll ever use. I made sure to get my limits way up there, so even if I made a large purchase, my utilization will stay down and keep my score high.

Originally posted by venomous99:

quote:aside from the obvious stuff like reducing debt and keeping your long standing credit cards open and active

Originally posted by FivePTSlow:

I'm getting there, the only thing holding me back now is the average age of my credit is low. That's the one area I can't do much about except wait.

Once I pay off my last of the credit card debts soon, and 3 inquiries drop off this year I'm sure I'll see a huge bump in my score.

,it helps to increase your credit line every so often.

http://www.bankrate.com/finance/credit/will-credit-limit-increase-hurt-score.aspx

quote:Yes, as with most things, huge limits come with huge responsibility. I have less than $2k in credit card debt, so my utilization is extremely low. I can pay this debt off at any point, but they're both at 0%, so no rush.

Originally posted by stanger00:

quote:That's great idea until your minimum payments add up to or over 40 to 50% of your monthly income.

Originally posted by FivePTSlow:

quote:I have about $100k in credit line for credit cards, that's way more than I'll ever use. I made sure to get my limits way up there, so even if I made a large purchase, my utilization will stay down and keep my score high.

Originally posted by venomous99:

quote:aside from the obvious stuff like reducing debt and keeping your long standing credit cards open and active

Originally posted by FivePTSlow:

I'm getting there, the only thing holding me back now is the average age of my credit is low. That's the one area I can't do much about except wait.

Once I pay off my last of the credit card debts soon, and 3 inquiries drop off this year I'm sure I'll see a huge bump in my score.

,it helps to increase your credit line every so often.

http://www.bankrate.com/finance/credit/will-credit-limit-increase-hurt-score.aspx